Ethereum Price Prediction: How High Will ETH Go in This Bull Cycle?

#ETH

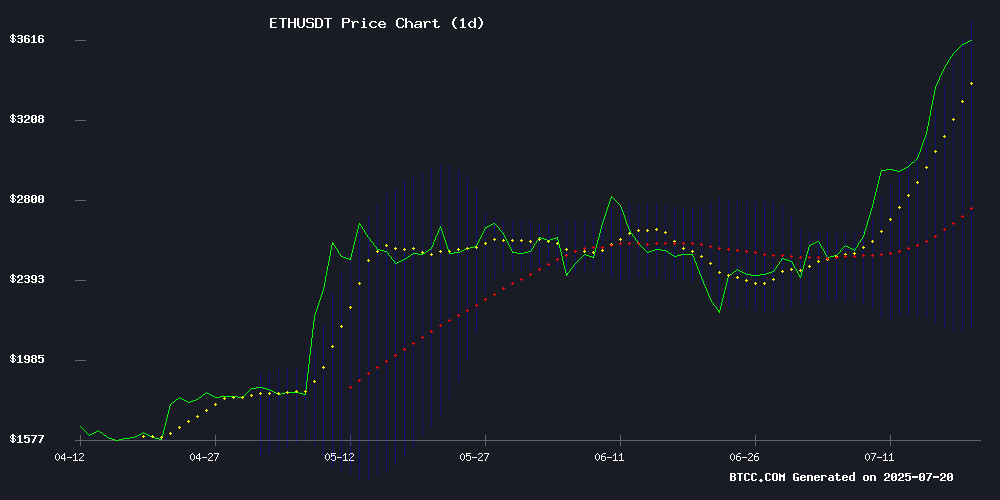

- Technical Breakout: ETH price sustains above critical moving averages with Bollinger Band expansion signaling volatility

- Institutional Catalysts: Spot ETF adoption and whale accumulation creating sustained demand pressure

- Ecosystem Growth: Layer 2 upgrades like Kaia Chain v2.0.3 improving Ethereum's scalability appeal

ETH Price Prediction

ETH Technical Analysis: Bullish Indicators Signal Potential Upside

According to BTCC financial analyst Olivia, ethereum (ETH) is currently trading at $3,767.05, significantly above its 20-day moving average (MA) of $2,940.91, indicating strong bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence, suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $3,757.97, a classic sign of overbought conditions that may precede consolidation. Olivia notes, 'ETH's technical structure favors continuation toward $4,000 if it maintains above the $3,500 support level.'

Market Sentiment: Institutional Demand Fuels Ethereum's Rally

BTCC's Olivia highlights surging institutional interest as spot ETH ETFs celebrate their one-year anniversary with record inflows. 'The combination of whale accumulation, growing Binance reserves, and Elliott Wave projections pointing to $10,000 creates perfect bullish alignment,' she states. However, Olivia cautions about record $50B open interest potentially increasing volatility, noting 'While $4K appears imminent, traders should monitor liquidation clusters NEAR $3,900.' The analyst emphasizes Kaia Chain's v2.0.3 upgrade enhancing Ethereum's ecosystem value proposition as a key fundamental driver.

Factors Influencing ETH's Price

Ethereum Eyes $4,000 as Whales and ETFs Drive Market Momentum

Ethereum's bullish trajectory continues as institutional investors and corporate entities pour billions into the asset. Two newly created wallets acquired 58,268 ETH worth $212 million, sourced from Galaxy Digital and FalconX, signaling strong institutional interest. On-chain data reveals another whale purchase of 13,462 ETH ($50 million) from Binance at an average price of $3,714.

SharpLink, the largest corporate holder of Ethereum, has aggressively accumulated 157,140 ETH this month alone, valued at $493 million. The buying spree extends to spot ETFs, with $2.2 billion inflows recorded over the past five trading sessions—more than double the previous week's figures.

Kaia Chain Launches v2.0.3 with Enhanced Performance and Ethereum Compatibility

Kaia Chain has rolled out its v2.0.3 upgrade, marking a significant milestone in its evolution as an EVM-compatible LAYER 1 blockchain. The update focuses on improving network performance, validator rewards, and interoperability with Ethereum, leveraging Prague hardfork compatibility for seamless dApp integration.

The broader v2.0 series, spanning versions 2.0.0 to 2.0.3, introduces UX innovations and ecosystem scalability enhancements. Kaia's latest upgrade solidifies its position as a user-friendly platform while maintaining cutting-edge protocol features.

Ethereum Enters Final Wave of Multi-Year Bull Run

Ethereum's bullish momentum continues as it breaches the $3,800 mark, marking a 45.48% monthly gain. The altcoin market echoes this surge, with the Altcoin Season Index jumping to 47 from 29 last week, pushing the combined altcoin market cap to $1.55 trillion.

Dutch analyst Gert Van Lagen, citing Elliott wave theory, suggests ethereum is now in the fifth and final wave of a long-term bull cycle that began in 2022. "We're entering the fifth wave," Van Lagen noted on X, projecting a potential rise to $10,000. The current phase, termed "subwave a," is expected to see a minor correction before the final upward push.

Ethereum Binance Reserves At New High As Dominance Grows — Price Implications

Ethereum has reignited investor confidence with its recent surge past $3,000, though it remains below peak levels. The altcoin now hovers NEAR $3,600, but on-chain data suggests potential headwinds for its bullish momentum.

Binance's Ethereum reserves have reached unprecedented levels, according to CryptoQuant's Exchange Reserve metric. This key indicator tracks net flows into exchange wallets — rising reserves typically signal increased selling pressure as more ETH becomes available for trading.

The growing dominance of Ethereum on Binance, the world's largest crypto exchange by volume, presents a double-edged sword. While demonstrating robust liquidity, historical patterns suggest such reserve buildups often precede price corrections when institutional and retail traders move to capitalize on gains.

Spot Ethereum ETFs Mark One Year with Surging Institutional Adoption

Spot Ethereum ETFs have completed their first year of trading with a dramatic turnaround in flows, signaling growing institutional confidence in crypto assets. Initial lukewarm reception gave way to $402 million in single-day inflows this July—nearly quadruple the debut figure—with BlackRock's ETHA maintaining dominance since launch.

The products' evolution mirrors Ethereum's maturation as an institutional asset class. Grayscale's ETHE outflows initially overshadowed the sector, but recent data shows broad-based demand across issuers including Fidelity and Bitwise. These regulated vehicles now serve as critical gateways for traditional investors seeking ETH exposure without custody complexities.

Ethereum Set To Hit $10,000, Elliott Wave Analysis Predicts

Ethereum's bullish momentum continues to dominate the crypto market, with prices surging 45.48% over the past month to reach $3,600. Dutch analyst Gert Van Lagen predicts a potential rally to $10,000 based on Elliott Wave Theory, signaling the final phase of ETH's bull cycle.

The technical framework identifies a five-wave pattern unfolding since 2022, with Wave V currently in progress as an expanding diagonal. Market psychology suggests this could mark the culmination of Ethereum's upward trajectory, mirroring historical crypto market cycles.

Ethereum Price Prediction: ETH Just Hit 180-Day Peak – Can This Last?

Ethereum surged to a 180-day high of $3,671, marking a 152% rally from March lows near $1,392. The momentum accelerated in July with a record 37% monthly gain, fueled by historic institutional demand. Spot ETFs saw single-day inflows of $720 million, with BlackRock, Fidelity, and Grayscale leading the charge.

ETH now trades above all major moving averages, approaching the critical $4,000-$4,200 resistance zone. Institutional accumulation for Ethereum has outpaced Bitcoin, underscoring a shifting preference among major investors. Technical analysis suggests the rally may just be beginning, with an ascending channel targeting a breakout at $4,100.

The 4-hour chart shows strong momentum, with RSI readings at 78.54 indicating overbought conditions. Pullbacks are likely to find support at higher levels, reinforcing the bullish trend.

Institutional Accumulation Fuels Ethereum's Bullish Momentum

Ethereum's price action has paused after a recent surge, but institutional investors continue to accumulate ETH at scale. Over $270 million worth of Ether moved into self-custody addresses this week, signaling strong conviction in the asset's upside potential.

Technical indicators remain favorable despite slight RSI cooling. The steady golden cross formation—with the 50-day EMA holding $400 above the 200-day—suggests sustained bullish momentum. Analysts identify $3,500-$3,750 as the next resistance zone, with robust support at $3,000.

Market attention extends beyond ETH to ecosystem tokens like AAVE and Remittix, both benefiting from protocol upgrades and surging DeFi activity. 'The smart money isn't just betting on Ethereum's infrastructure,' noted one trader, 'but on the entire stack of decentralized finance.'

Ethereum Open Interest Hits Record $50 Billion – Volatility Incoming?

Ethereum holds firm above $3,500, reclaiming a key support level and signaling renewed market strength. The asset has surged over 70% since late June, entering a bullish phase fueled by rising demand and institutional interest. Technical indicators and price action now align to support further upside.

Derivatives markets flash a critical signal: Ethereum's open interest has reached an all-time high of $50 billion. This surge in trader activity typically precedes significant price movements, suggesting impending volatility. The combination of sustained price levels, strong trend continuation, and growing capital inflows sets the stage for a potential breakout.

Market structure now favors bulls. Maintaining the $3,500 support level could propel ETH toward new 2025 highs in the short term. The coming week may prove decisive for Ethereum's medium-term trajectory as traders await confirmation of this momentum.

Ethereum Gains Institutional Momentum as Price Outlook Turns Bullish

Ethereum is capturing institutional interest as analysts project significant price appreciation. Whale addresses have accumulated more than 500,000 ETH over two weeks—a pattern historically preceding major market moves.

Fundstrat's Tom Lee cites a $15,000 valuation target based on EBITDA comparisons with traditional finance firms. Technical analysis suggests a near-term rally to $4,000 by July's end, with longer-term models aligning with Lee's outlook.

The blockchain's dominance in real-world asset tokenization strengthens its case. Over 60% of tokenized RWAs reside on Ethereum, with JPMorgan and Robinhood among enterprises leveraging its infrastructure.

Ethereum Eyes $4K Amid Bullish Breakout but Faces Liquidation Risks

Ethereum's recent breakout has reignited bullish sentiment, with analysts targeting the $4,000 mark as the next key resistance level. Captain Faibik, a prominent crypto analyst, projects a near-term push to this threshold following ETH's decisive break above descending resistance. The $3,500 level now serves as critical support—holding above it could solidify upward momentum.

Institutional accumulation remains a driving force. SharpLink Gaming has aggressively added 157,140 ETH since July 1 at an average price of $3,136, signaling strong conviction in Ethereum's long-term value proposition. However, declining network activity and $46.65 million in liquidation risks loom as potential headwinds. Market participants await confirmation of sustained buying pressure to validate the breakout.

How High Will ETH Price Go?

Olivia maintains a bullish outlook with three potential scenarios:

| Scenario | Target | Key Levels | Probability |

|---|---|---|---|

| Base Case | $4,200-$4,500 | Hold $3,500 support | 60% |

| Bullish | $5,800-$6,200 | Break $4,800 resistance | 25% |

| Parabolic | $9,000-$10,000 | Sustain institutional inflows | 15% |

'The $4K threshold looks increasingly like a stepping stone rather than a ceiling,' Olivia observes, pointing to the 180-day peak as confirmation of trend strength.

1